Our Services

Consist of delicate and dedicated tax professionals, we assure you that there's nothing to worry about when we handle your tax issues. You are in a good hand. In Taxvisory, we believe integrity is the key value to deliver success within our competencies that we deliver through our services.

Why Taxvisory?

- Integrity is our core value.

- Delicate and experienced tax professional.

- Always comply with updated tax regulation.

- Fun to work with.

- Provide a tailor-made solution.

Our Highlights

Tax has been a headache for some business owners in Indonesia for quite some time. Layered and fast-changing regulation make it even worse. But no worries, Taxvisory is here to assist, for now and for good. Supported with delicate and dedicated tax professional, we are confident to provide an all around tax service. Instead of being a one time project based consultant, we believe we have capabilities to be your day-to-day tax adviser and reliable business partner.

We have been trusted by clients from various industry in Indonesia to take care their tax issue. Trust us in handling your tax planning, tax review and other tax related cases. Let us ease your headache. Let us set you free. Let us be your tax adviser. Let us fulfill our commitment to be your good business partner.

SELAMAT TAHUN BARU IMLEK DAN MARHABAN YA RAMADHAN

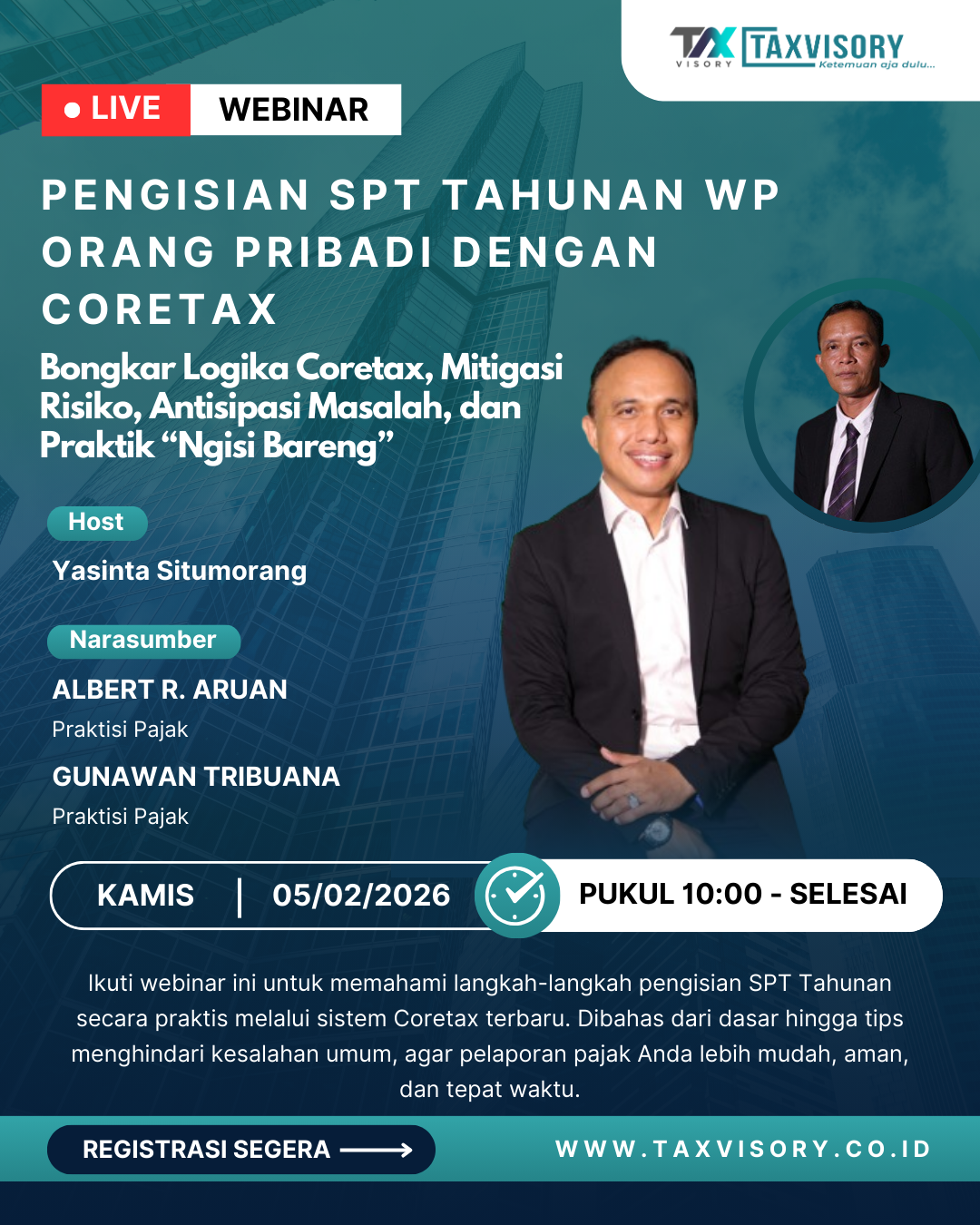

PENGISIAN SPT TAHUNAN WP ORANG PRIBADI DENGAN CORETAX

Bongkar Logika Coretax, Mitigasi Risiko, Antisipasi Masalah, dan Praktik “Ngisi Bareng”

Ikuti webinar ini untuk memahami langkah-langkah pengisian SPT Tahunan secara praktis melalui sistem Coretax. Mulai dari dasar hingga tips menghindari kesalahan umum, agar pelaporan pajak Anda lebih mudah, tepat waktu, dan bebas risiko.

Materi yang Akan Dibahas

- Pengenalan Sistem Coretax

Mengenal tampilan dan fitur terbaru perpajakan Indonesia yang menggantikan DJP Online. - Aktivasi & Login

Panduan sukses login menggunakan NIK sebagai NPWP di sistem Coretax. - Persiapan Dokumen

Checklist dokumen bukti potong, daftar harta & utang, dan data pendukung lainnya. - Praktik & Ngisi Bareng SPT Tahunan

Tutorial step-by-step pengisian SPT Orang Pribadi langsung di Coretax. - Pembuatan Kode Billing

Cara mudah menyetor pajak untuk SPT dengan status Kurang Bayar. - Sesi Tanya Jawab (Q&A)

Konsultasi langsung atas kendala dan permasalahan pajak Anda.

Benefit Peserta

- E-Certificate

- Rekaman Webinar

- Materi Presentasi

Penyelenggara

TAXVISORY

Biaya Pendaftaran

- Early Bird: Rp500.000 (sampai 31 Januari 2026)

- Normal: Rp800.000 (sampai 04 Februari 2026)

Informasi Pembayaran

Bank: CIMB Niaga

No. Rekening: 800156007600

A.n: Empu Fiskalegal Indonesia

Waktu & Pelaksanaan

Hari/Tanggal: Senin, 05 Februari 2026

Jam: 10.00 WIB – Selesai

Tempat: Zoom Meeting

(Link Zoom akan dibagikan setelah peserta masuk grup WhatsApp)

Pemateri

Dr. Albert Richi Aruan, S.H., LL.M., M.Kn., CTA

Tim Asisten

Gunawan Tribuana, S.Kom., CTA

Link Pendaftaran

👉 Klik di sini untuk mendaftar

Contact Person

- Putra: 0812-1431-4972

- Yasinta: 0822-9529-0242

- Jordan: 0813-1316-7033

Our Team

Albert R. AruanManaging Partner Starting his career as a government employee at the Directorate General of Taxes (DGT) in 1996, Albert has shown experience for 27 years and still counting. Obtaining a law degree from the University of Lampung, he continued his master's degree in law (LL.M.) at the College of Law, University of Illinois at Urbana-Champaign (UIUC), USA. Now, he is pursuing doctoral degree in law at University of Indonesia with research subject in cryptocurrency as property and its taxation. |

Albertien E. PiradeSenior Advisor Graduated from Economic Faculty, UKI, Jakarta, she joined Directorate General of Taxation, Ministry of Finance from 1996 to 2015 and assigned on highest position as echelon 3. While in DGT she received master scholarship to UIUC, USA. In 2016 she joined President's Staff Office to help duty of the President of Republic of Indonesia until 2023. In 2017, she achieved PhD degree from IPB, Bogor. To broaden her educational field, she took Bachelor of Law at UKI, and shortly after graduated in 2023 she holds a position as Senior Advisor at Taxvisory, a leading business and tax consulting in Jakarta. |

Herry NigiaSenior Advisor With over 30 years’ extensive experience in banking industries as leading more than 100 subsidiaries. Excellent skill such as Banking product (Loan, Funding, Fee Base Income), System & Procedure, Product Developmen as well as managing and motivated people. |

Putra Pratama SimatupangJunior Advisor |

Yasinta Marito SitumorangJunior Advisor |

Aditya JordanJunior Advisor |